17+

Investors

$15k+

Fund

3+

Countries

About FiaToBTC

What is FiaToBTC ?

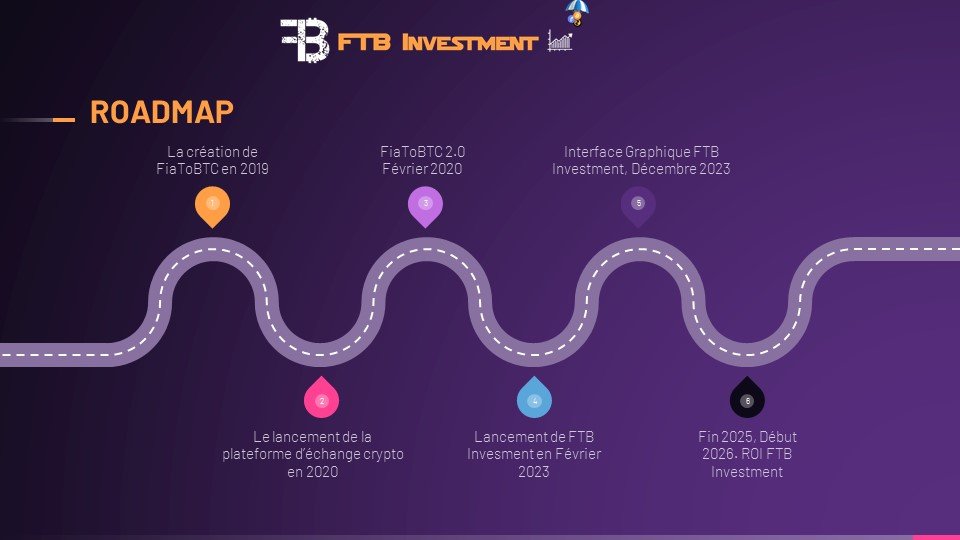

FiaToBTC (FTB) is a company offering a cryptocurrency exchange service. Founded in 2018 by Eldad Kanawa, FiaToBTC's mission is to make it easy for Congolese people to acquire cryptocurrency using local payment methods (Mobile money) that are accessible to everyone.

What is FTB Investment ?

FiaToBTC Investment is a speculative fund focused on investing in cryptocurrencies to

benefit from them and share the profits generated with its investors.

FiaToBTC is pleased to announce the launch of this fund to enable you to profit from

your investment.

This fund will therefore be invested in the exchange of the most liquid stock assets of

our time:

cryptocurrencies (Bitcoin, Avalanche, Polkadot, Ethereum, etc.) and with high potential

according to market analysis.

Reasons to Invest in FTB

Drawing on his over 5 years of experience in the cryptocurrency field, Eldad Kanawa, CEO of FiaToBTC, has decided to launch FTB Investment, a speculative fund focused on investing in cryptocurrencies. He spent several months researching and analyzing the market, identifying potential investment opportunities, and developing a comprehensive investment strategy that will allow any investor to make profits from this activity.

FiaToBTC has gathered a team of experienced analysts to help manage the fund and maximize returns for investors while trying to minimize potential risks associated with this highly volatile market.

The FiaToBTC team is confident that their knowledge and experience in the cryptocurrency industry will help us achieve great things together.

My Experience

As the founder and lead investor of FTB Investment, my experience and success in the

cryptocurrency market make me a valuable asset to potential investors.

In the previous bear market, I executed a long position on BTC. The average entry price

was 4,900 USD and closed at 55,000 USD.

This trade generated significant returns. 35,000 USD for 1,500 in the trade. This

demonstrates my ability to navigate the volatile cryptocurrency market successfully.

My experience has allowed me to identify profitable opportunities and develop a sound

investment strategy that mitigates risk while maximizing returns.

Investing with FTB Investment means having access to this expertise and a commitment to

transparency and ethical investing.

Frequently Asked Questions (FAQ)

Investment Strategy

Our investment strategy is based on two very simple terms: Bear Market and Bull Run.

So, what do these two terms mean? In simpler terms, Bull Run means a rising market

and Bear Market means a falling market.

A Bull Run or Bull Market is a prolonged period during which stock prices or other

assets (such as cryptocurrencies) are constantly rising.

Bull markets are often characterized by investor confidence and the strength of the

economy in general.

On the other hand, a Bear Market is only the final phase of a complete cycle that

included a crypto bull run.

A Bull Market is therefore opposite to the Bear Market. The Bear Market occurs when

stock prices are falling.

The following classification makes the difference easily understandable: Bulls rage

when they are excited. Known for their speed, they symbolize a booming stock market.

As for Bears, they are gloomy and cautious. They are associated with a state of

hibernation, so they perfectly represent an image of a declining or stagnant stock

market.

The opportunity behind Bear Market

The cryptocurrency market has entered a bearish phase for several months.

98.5% of cryptocurrencies have seen their prices fall by at least 90%. Synonymous

with loss, the bear market is too often seen as a disaster.

However, with our experience in the cryptocurrency field, we have understood that a

bear market, just like a crypto bull run, is only a phase in a much more complex

cycle.

Indeed, it must be understood that all financial assets, such as cryptos, are

subject to what are called cycles.

For stocks, these cycles have a lifespan of 10 years or even much more. As for

cryptocurrencies, these cycles are much more limited in terms of time and can run

for a maximum of 5 years.

Their cyclical nature alternates roughly between periods of rising and falling

prices over several months or even several years for some stocks.

Taking the form of successive waves, these cycles allow savvy investors and traders

to position themselves and act accordingly to make gains.

To illustrate these cycles, let's take the example of Bitcoin, the most important

cryptocurrency in terms of capitalization and notoriety.

Although it is generally bullish in nature, this cryptocurrency has repeated the

same pattern since its inception. Each cycle is broken down into 4 distinct phases,

as shown in the image below.

Since its launch, Bitcoin has always respected this same pattern at regular time intervals. In this perspective, we can easily envision the hope that the bear market is only temporary and that a crypto bull run will emerge in the near future. This time is precious because it will allow you to prepare optimally to make gains of up to 1000%. So, as you may have understood, the FiaToBTC team, with its experience in the field, plans to use appropriate strategies for the current bear market to enable us to make juicy profits before the bull run arrives.

Risk Management

Warning

Everything in the universe, from the smallest fern leaf to global financial

transactions, is balance.

Everything is based on a certain form of balance, even if it is precarious.

The more secure a support is, the less profitable it will be.

Therefore, while the gains and returns of cryptocurrencies can be very

significant, the potential risks will be just as high on the other side...

It's a matter of balance.

Cryptocurrencies being highly speculative, the risks are mainly related to their

volatility.

Unexpected changes in market sentiment can lead to significant and sudden price

movements.

It is not impossible for the value of cryptocurrencies to quickly drop by

hundreds or even thousands of dollars, leading to losses or, on the other hand,

to rise in the same way, leading to gains.

Thus, any investor in the cryptocurrency field should be aware of the risks

associated with it.